COBRA Health Insurance: A Bridge, But Not Forever (and Maybe Not the Best Fit)

Congratulations! You just changed jobs, started your own business, or maybe even embarked on a well-deserved retirement. But amidst the excitement of this new chapter, there's a crucial aspect to consider: health insurance. This is where COBRA (Consolidated Omnibus Budget Reconciliation Act) comes in.

COBRA Health Insurance: A Temporary Lifeline

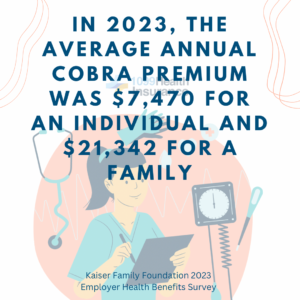

COBRA health insurance allows qualified individuals to temporarily continue their employer-sponsored health plan after a qualifying event, such as job loss, reduced work hours, or certain life changes. It's a safety net, but with a significant caveat: you become responsible for the entire premium – the amount your employer previously paid on your behalf plus your own share. This can be a substantial cost increase. A 2023 Kaiser Family Foundation study revealed that the average annual COBRA premium was a staggering $7,470 for an individual and a hefty $21,342 for a family).

Who Qualifies for COBRA Health Insurance?

- Employees who involuntarily lose their job (e.g., layoffs, company closures)

- Employees with reduced work hours falling below a specific threshold

- Spouses and dependents losing coverage due to the employee's qualifying event

COBRA: 60-Day Window to Continue Coverage After Job Loss

After your employment ends, you have a critical 60-day window to decide on COBRA health insurance. If you miss that window, you'll have to find an alternative for your health coverage.

The COBRA Clock is Ticking: How Long Does It Last?

COBRA coverage typically lasts for 18 months, with some rare exceptions extending it to 36 months, from the qualifying event. While this may seem like a decent amount of time, finding a new, more affordable plan can be challenging for some.

COBRA vs. Alternatives: Exploring Your Options

While COBRA offers continued coverage, the high cost can be a burden. This is where a dedicated 1099 Health Insurance licensed advisor can be an invaluable resource. They can help you explore alternative options that might better suit your needs and budget.

Marketplace Plans: A Potentially Subsidized Option

The Affordable Care Act (ACA) Marketplace offers subsidized health insurance plans for qualified individuals and families. Depending on your income, you may be eligible for tax credits that significantly lower your monthly premiums. A licensed advisor can help you determine if you qualify for subsidies and navigate the enrollment process.

Private Health Insurance Plans: Finding Similar Coverage

Choosing a private insurance plan has become a very attractive option for many who have lost coverage from an employer-sponsored plan. Depending on your health status and individual circumstances, you may be able to find very similar coverage to what you had through your group plan, but at a significantly lower cost.

Short-Term Health Insurance: A Temporary Lifeline

Short-term health insurance plans provide temporary coverage for a limited period (typically up to 12 months) and can be a more affordable option while you search for a long-term solution. It's important to understand that these plans are designed for short-term needs and may have limitations on coverage, including pre-existing conditions. A licensed advisor can explain these limitations and advise you on whether a short-term plan is a suitable option for you.

PPO Blues: A Word on Network Changes

It's important to note that your COBRA plan may not be identical to your employer-sponsored plan. Some employers offer PPO plans that allow you to see any doctor within the network. However, the COBRA version might be an HMO plan that restricts your choice of doctors.

The Takeaway: Explore Your Options with a Licensed Advisor

COBRA can be a helpful tool, but it's not always the most cost-effective solution. Consulting with a dedicated 1099 Health Insurance licensed advisor can help you navigate your options, understand the associated costs, and find the right coverage for your situation. Remember, this information is for general knowledge only and does not constitute financial or legal advice. For specific questions about your situation, consult a healthcare or tax professional.

Schedule a Free Consultation with a Licensed Advisor Today!

Don't wait until the COBRA enrollment deadline approaches. Take charge of your health insurance today! A licensed advisor can help you explore all your options and find the best fit for your needs and budget. They can be reached by phone or online scheduling.