What is Accidental Death and Dismemberment (AD&D)?

Accidental death and dismemberment (AD&D) is a type of insurance policy that provides financial protection in case of accidental death or dismemberment. It acts as a supplement to your regular life insurance policy by providing a payout if you die or suffer a serious injury due to an accident.

Why is AD&D important?

Accidents can happen to anyone, at any time. While life insurance offers financial security to your loved ones in case of your death, it doesn't cover accidental deaths. Here's why AD&D is an important consideration, especially for those who are self-employed or don't have life insurance:

- Self-employed individuals: If you are self-employed, you likely don't have employer-sponsored life insurance. AD&D can provide a financial safety net for your family in case of an unexpected accidental death.

- No life insurance: If you don't have life insurance, AD&D can be a more affordable way to secure some level of financial protection for your loved ones in case of accidental death.

Benefits of AD&D

- Peace of mind: AD&D can provide peace of mind knowing that your family will be financially protected if you are in an accident.

- Financial protection: The payout from an AD&D policy can help cover expenses such as funeral costs, medical bills, and lost income.

- Relatively affordable: AD&D premiums are typically lower than traditional life insurance premiums.

Key takeaways

- Accidental death and dismemberment (AD&D) is an insurance policy that pays a benefit in case of accidental death or dismemberment.

- AD&D is a valuable supplement to life insurance, especially for self-employed individuals or those without life insurance.

- AD&D can provide financial protection for your family in case of an unexpected accident.

Remember: AD&D policies may have exclusions, so it's important to carefully review the policy details before purchasing.

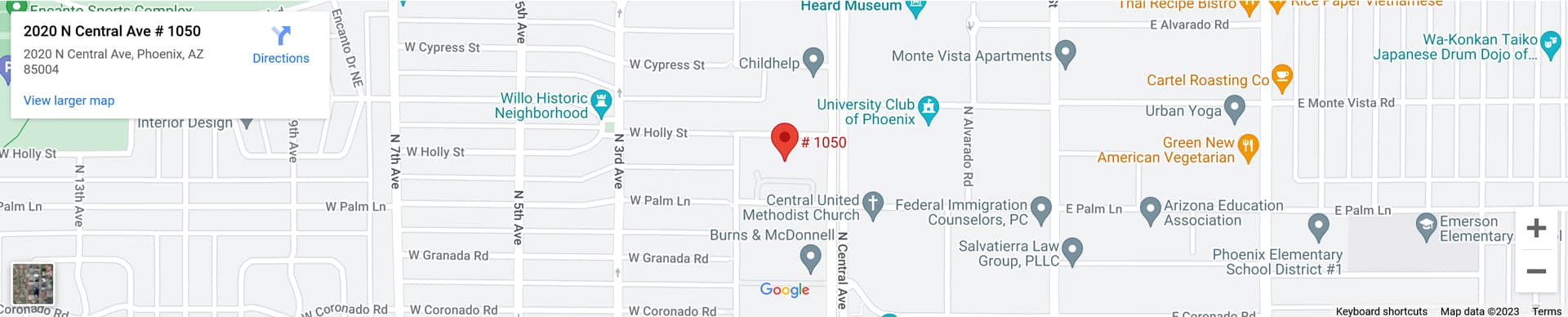

Please contact us for more information on how an AD&D policy can help you.